income tax rate indonesia

Based on the evaluation income from construction services may be subject to regular income tax under Article 17 of the Income Tax Law. The changes under the HHP Law are very significant.

Personal Income Tax Rate Rp Rp 1-50 million.

. Portion of income between Rp 50-250 million. Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator. Except for self-assessed VAT on utilization of intangible taxable goods andor.

According to the latest. Building Permanent 20 years 5 Non-permanent 10 years 10 The comprehensive lists of the assets included in each category. The Indonesian tax office Direktorat Jenderal Pajak requires all resident individuals in Indonesia to have their own personal tax numbers Nomor Pendaftaran Wajib Pajak or NPWP.

Indonesia Residents Income Tax Tables in 2020. The changes include a new top individual income tax rate of 35 on income over IDR 5 billion in addition to an increase in the upper threshold for the 5 rate from IDR 50 million to IDR 60 million. Indonesia Individual Income Tax Guide 9 Individual Tax Rates Resident Taxpayer The standard tax rates on taxable income received by resident taxpayers are as follows.

Non-residents are subject to a final withholding tax of 20 percent on gross income. Content provided by Deloitte Indonesia. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

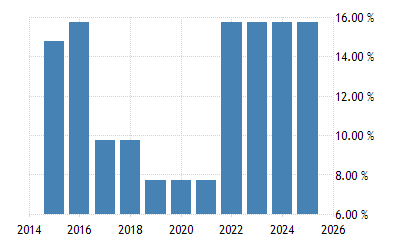

Portion of income over Rp 500 million. For fiscal year 20202021 the CIT rate is 22 and for the year 2022 onwards the CIT rate will be 20. The Personal Income Tax Rate in Indonesia stands at 30 percent.

The provisions take effect at varying times eg for income tax purposes from the 2022 Fiscal Year and for VAT purposes from 1 April 2022. Taxpayers can extend the period of submission of the annual income tax return for 2 two months at the maximum by submitting notification to the ITA. Above IDR 50 million.

Personal Income Tax Rate 3000. For resident taxpayer the top marginal income tax rate is 30 for income above IDR 500 million. Social Security Rate 774.

Your average tax rate ends up being around 0. 1997-2021 Data 2022-2024 Perkiraan. Taxable Annual Income.

Note that this estimate is based only on the most common standard. 6 rows Taxable income IDR Tax rate Up to IDR 50 million. 5 rows In general a corporate income tax rate of 25 percent applies in Indonesia.

The new rates effective from January 2022 can be found in the table below. Calculate your take home pay in Indonesia thats your salary after tax with the Indonesia Salary Calculator. Indonesian Tax Guide 2019-2020 9 3.

Taxable Income Rate Up to Rp 50000000 5 Over Rp 50000000 but not exceeding Rp 250000000 15 Over Rp 250000000 but not exceeding Rp 500000000 25 Over Rp 500000000 30. The implementation of the final income tax rates under PP-9 will be evaluated by the Minister of Finance three years after PP-9 comes into effect. The corporate income tax CIT rate in Indonesia is 25.

Sales Tax Rate 1000. A quick and efficient way to compare salaries in Indonesia review income tax deductions for income in Indonesia and estimate your tax returns for your Salary in IndonesiaThe Indonesia Tax Calculator is a diverse tool and we may refer to it as the Indonesia wage. 6 Indonesian Pocket Tax Book 2021 PwC Indonesia Corporate Income Tax Tangible Assets Categories Useful Life Depreciation rate Straight line method Declining balance method Category 3 16 years 625 125 Category 4 20 years 5 10 II.

One of the changes to the income tax regulations Regulation No. For non-resident individuals they are subject to a 20 percent withholding tax on Indonesia-sourced income. From January 2022 new progressive income tax rates come into effect in Indonesia.

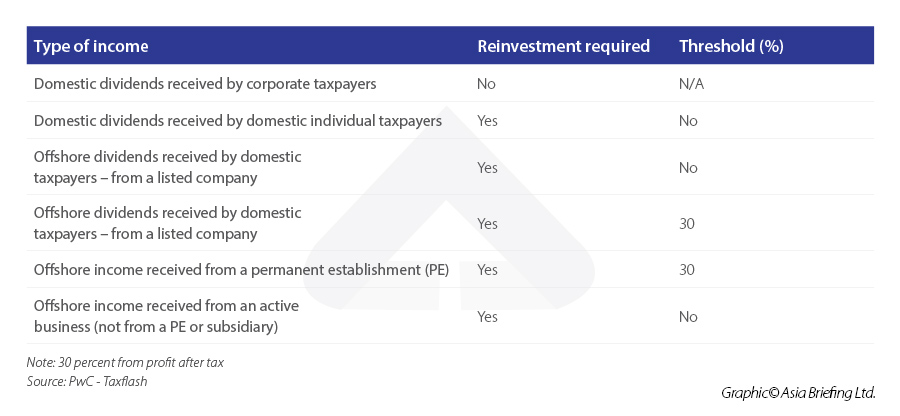

The Indonesian Government has passed the Tax Regulations Harmonization Law HPP Law on 7 October 2021 and it became Law No 7 2021 on 29 October 2021. Corporate Tax Rate 2200. 18PMK032021 pursuant to changes introduced by the Omnibus Law enacted 2 November 2020 provides a tax exemption for certain domestic and foreign dividend income subject to certain conditions.

Nilai saat ini data historis perkiraan statistik grafik dan kalender ekonomi - Indonesia - Tarif Pajak Perusahaan. Net taxable income for residents is taxed at graduated rates. Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator.

Personal Income Tax Rate in Indonesia averaged 3156 percent from 2004 until 2019 reaching an all time high of 35 percent in 2005 and a record low of 30 percent in 2009. Portion of income between Rp 250 million-500 million. Public companies that have a minimum listing requirement of 40 and other specific conditions are eligible to a 3 cut off from the standard CIT rate.

This regulation also applies to expatriates. This applicable tax rates are progressive based on annual income. 07 Jan 22.

The current rates range from 5 percent up to a maximum of 30 percent for income earned over 500 million Indonesian rupiah IDR. Tax exemption available for dividend income. Below are applicable income tax rate for individual taxpayer.

In Indonesia tax services are provided by Deloitte Touche Solutions. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for.

Income Tax Rate For Llp For Fy 2020 21 Provenience Provenience Internal Audit Research Paper Audit

Short Article On Vernacular Press Act This Act Was Aimed At Curbing The Freedom Of Expression Of Leaders In Their Regio Income Tax Return Income Tax Irs Taxes

Indonesia Average Retail Price Pack Of Clove Cigarettes 2019 Statista

Personal Income Tax Calculator In Indonesia Free Cekindo Di 2021

Indonesia S Economy To Return To Growth In 2021 Adb Asian Development Bank

Tax Return Thornton Indirect Tax Tax Tax Debt

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

Home Quora Per Capita Income Income Economy

In This Research Of Singapore And India We Measure Indicators Ranging From Demography Company Incorporation Corporate Tax Rate Singapore Business Infographic

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Olx Autos Indonesia Service Is Now Available At Jd Id Auto Service Car Buying Sell Used Car

Standard Vat Rate Indonesia 2021 Is 10 In 2021 Indonesia 10 Things Calculator

Top 8 Things To Know About Taxes For Expats In Indonesia

Why Indonesia Should Raise The Income Tax Of The Ultra Rich Individuals

Djp Online Adalah Cara Termudah Dan Paling Pantas Bagi Wajib Pajak Untuk Membayar Pajak Tepat Waktu Tanpa Perlu Rep Capital Gains Tax Income Tax Tax Deductions

Emerging Markets Most Exposed To A Sudden Stop Business Insider External Debt Marketing Emergency

Indonesia Social Security Rate 2021 Data 2022 Forecast 2007 2020 Historical

Over 1 300 I T Notices From Old Regime Quashed By Delhi Hc Income Tax Filing Taxes Tax Refund